Have you ever wondered why, relatively speaking, there is less airplane failure in mid-air, even if an engine catches fire or some other similar major event? I will tell you at the end of the blog.

‘sweat your asset’, ‘cash is king’, ‘risk management’, ‘diversify or die’, ‘the customer is always right’. On and on we coined these truisms and phrases to articulate our business philosophy or to justify our strategies.

No doubt, some, if not all of these truisms, can be right providing business conditions are within the spectrum of normality.

However, we are now living through very unusual times of a full-on pandemic, which most of us believe will prove to be a game changer for pretty much all aspects of our lives. On this occasion however, I am mostly thinking of business and commerce.

When you survey the business landscape, you soon realise that ALL businesses, large, medium or small, got it wrong. We were ill-prepared to cope with COVID-19 Pandemic. Clearly, some did very well out of it, medical equipment and accessories suppliers, logistics and home delivery services, on-line shopping outlets, and food retailers. However, that wasn’t due to their clarity of vision and state of preparedness; they just got lucky; serendipity, if you like.

There was a time when companies defined their business strategies by articulating what their ambitions were in respect of their product(s); the market sectors they planned to penetrate or further penetrate; geographic expansion; and the anticipated financial return on their investments and activities. In other words, the ‘Four Pillars of Strategy’. No matter how well thought-out these strategies might have been, they were clearly way off the mark in terms of their resilience during the pandemic.

Now with the benefit of hindsight, it is easy for characters like me to come along and criticize the inadequacy of strategic planning across the entire business spectrum. That is not my intention. After all, I have been engaged in such activities for many years, so I claim no monopoly on wisdom here. What I am hoping to convey here is that we all have an opportunity to reflect, revise and architect somewhat different sets of business strategies. I must also stress that the change need not be total, whereby the Four Pillars of Strategy are enhanced rather than replaced.

Given that extraordinary events can and do happen, our strategic thinking needs to encompass more attributes than has hitherto been the case. We must take into account aspects such as resilience, flexibility, adaptability, and dynamic scaling. Before going into these aspects, let us take some examples of seemingly successful businesses that came unstuck during the pandemic.

Airlines: this industry, including cruise ships and ferries, has a high threshold of entry; you simply cannot set up shop and start trading in days, weeks or even months. It is also cash thirsty. Sir Richard Branson was once asked ‘does owning an airline make you a millionaire?’ He replied ‘yes, but you have to start as a billionaire’. Aircraft, even second-hand or leased ones require a great deal of investment to acquire. This is aside from having to secure landing slots, volatile fuel costs, maintenance and so on. Every airline will tell you that a key to profitability is sweating your asset, meaning that you must make sure this expensive asset is airborne as often and as long as possible. While on the ground, for whatever reason, your asset is not generating revenue but actually costing you money by the day. So, with severely restricted commercial flying, hundreds of airlines have literally trillions of dollars’ worth of assets parked neatly on airport tarmacs doing nothing other than draining cash resources.

Hospitality: including tourism, entertainment, cafes, bars and restaurants experienced almost a total shut down. I say ‘almost’ because a few of them maintained momentum because they had the flexibility to offer their services through different means, but, more on this a little later. So being starved of cash for a restaurant, cinema, music arena, etc. is a death sentence.

Sport: sport in general is now a global business with the ability to generate tens of billions of pounds sterling every year. Clubs and individuals are run as businesses and they have to deliver products sufficiently attractive and of the highest quality for it to be successful. An essential part of this product delivery is performance in venues such as stadia, track & field venues, boxing rings and so on. Unavailability of such venues due to natural disasters, or emergencies of any kind such as a pandemic that prevents assembly of paying customers, places the business in a precarious position.

Non-Food Retail: retail for clothes, especially fashion, furniture, accessories, toiletries, and most of what you would find in department stores, designated by authorities to be non-essential has come to a grinding halt. One example is Primark in the UK, that made a virtue out of selling fashionable clothing, especially for the young, at extremely low prices. In the UK, Primark moved from generating over £650 million per week to zero income. It is very hard to imagine recouping these losses quickly. Again, cash is king in this industry.

Manufacturing: What’s left of manufacturing in the West, from light to very heavy industry, has suffered right across the board. We are simply not buying, replacing or upgrading stuff either because we are not earning money ourselves or, we are uncertain of the future and we are clinging on whatever liquid assets we have for dear life. As a consequence, the ‘import, export market’ has also dramatically stagnated.

Housing Market: given all of the above, is it any wonder the housing market has also suffered? I am not particularly referring to the buy / sell that goes on between two private entities, which has also come to an abrupt halt. Rather, I am talking about the housing building industry that provides housing stock for first time buyers, all the way up the food chain of very large and very luxurious properties. Potential buyers are just not interested in shackling themselves to a very big mortgage debt which will hang around their necks for many years to come, particularly if ‘negative equity’ rears it’s ugly head during a potential recession following the pandemic.

Central Government: It is worth mentioning central governments because they were suddenly called upon to ‘fix the problem’. Politicians are no more qualified than the average business team to deal with huge challenges of this magnitude. However, with the power we invest in our elected politicians, together with the other pillars of the state of legislative, judiciary and armed forces, they have at their disposal extremely powerful instruments of combat and repair. The problem governments face in such situations is at their best they rely and listen to experts and at worst, they see it as a political opportunity to further their own agenda. In all cases, they are liable to firstly take their time before they act and then when they do act, they tend to use blunt instruments and over correct.

Further, most governments have racked up unimaginable amounts of debt trying to prop up the economy during the pandemic. Sooner or later, these debts will have to be dealt with and you guessed it, taxpayers will eventually foot the bill and that is bound to counteract against any economic bounce after the pandemic.

In summary, product and service providers found themselves unable to deliver their wares due to government and circumstantial imperatives. Consumers, however, have lost trust and confidence in the world they find themselves living in. Think about it, in Abraham Maslow’s hierarchy of needs pyramid, most of us, including the very rich and highly accomplished, are now languishing in the base of the pyramid trying to survive and preserve our lives. Occasionally, we climb up to the next level looking to meeting basic needs such as food and shelter. Sense of belonging, recognition, excelling and self-actualization are so far removed from our thinking, the idea of investing in new property, buying a new car, planning an exotic vacation, and so on are way off the charts for us.

So, where do we go from here? To begin with, I don’t believe that after COVID-19 has been defeated, we will go back to the old ‘normality’ and pick up where we left. We may do temporarily, immediately after the bulk of restrictions have been lifted but gradually, a new normality will prevail. In fact, if we were to go back to business as usual, it would be an opportunity missed to really review, learn, and revise our ways of working and living.

As individuals, nuclear families, clusters of friends, and communities will adopt a new set of social behaviour more suited to the new normality than the pre-COVID-19 days. We will adopt new sets of values that are more altruistic and family centric.

So, if the pre-COVID-19 strategy model will no longer work, what will the post-pandemic strategy model look like? The answer is that none of us really knows for sure. However, I am going to be foolish enough to stick my neck out and hazard a guess. So, here we go.

To begin with, I don’t believe we will abandon the Four Pillars of Strategy which encompass products and services, markets, geography and finance. Any business needs to be clear in its strategies as to how it intends to conduct business over the coming years. This is best articulated in those four pillars. The change is going to be what else we need to consider when we review and set out our business strategies. I believe there will be six elements that need to be deliberately and seriously taken into account when carrying out business strategic reviews. They are:

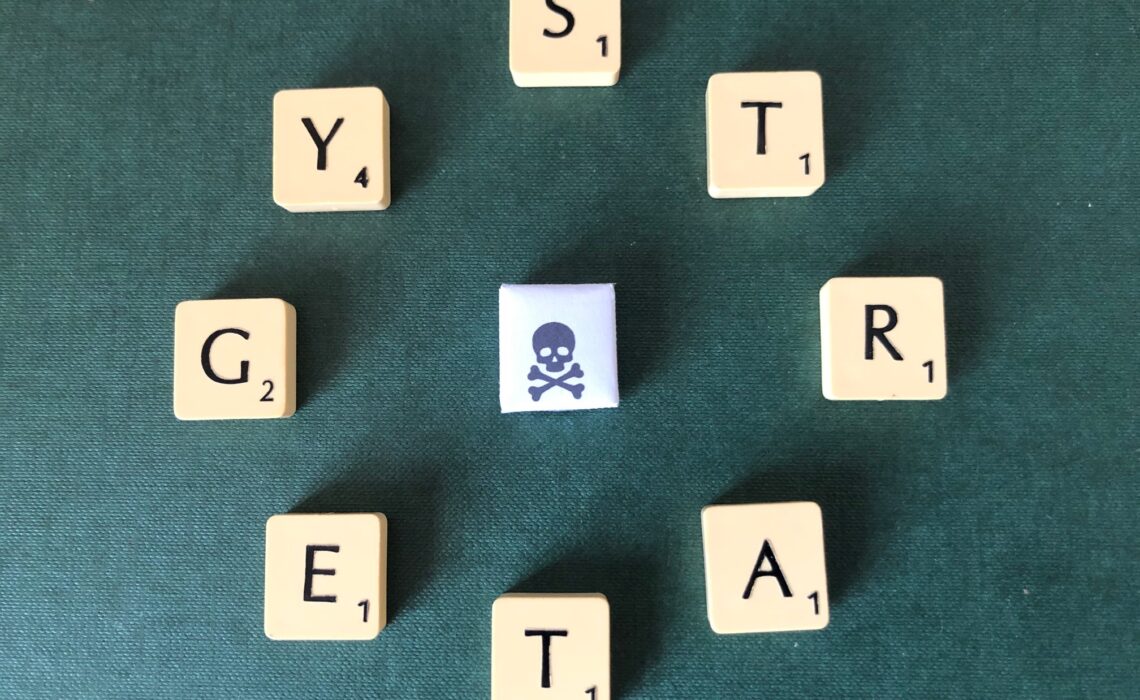

- Risk Assessment: Risk assessment has thus far, been paid lip-service but quite honestly, what came out was often too theoretical, standardized sets of questions with impressive output of heatmaps and an attempt at quantification of major risks. However, very few organisations actually took this topic seriously enough thereafter for it to make any difference. Besides, the risks considered were almost standard ones connected with potential unplanned circumstances but already known to the organisation. As far as I can recall, there never was any consideration given to catastrophic events such as a deadly pandemic and how an organisation might deal with such an eventuality. By definition, ‘risk’ is an unexpected event so, detailing and analysing expected risks is paradoxical. Risk managers need to up their game and bring a more appropriate risk assessment methodology and blue-sky potential solutions more seriously. Mitigating actions must also be appropriate to the identified risk, even if the cost appears to be prohibitive.

- Environmental: One of the unexpected manifestations of COVID-19 Pandemic has been the opportunity for nature to recover somewhat and take a breather, so to speak. All of a sudden, the air is clearer, river and coastal waters are cleaner, millions of tons of carbon have not been spewed into the atmosphere and most tangible of all, there are more birds and wild animals emerging from their self-isolation and living within close proximity to us, and wild flowers and plants are thriving in hitherto cultivated fields, thus enhancing our appreciation of nature more than ever.

More than any argument put forward by conservationists, this has been a real-life demonstration of what our planet Earth can be like, if only we all agree to look after it the way our ancestors did. This responsibility falls on the shoulders of business organisations to ensure that their strategic thinking accommodates environmental considerations for the greater good of all.

- Flexibility: The ability to bend and flex without breaking must be one of the tests a business strategy must pass. For instance, companies that were able to re-deploy their staff to work from home and conduct business as best as they could in the circumstances, have and will find themselves in a much stronger position to resume business at full tilt when the time comes. On the other hand, supermarkets who had at least 15 years warning that our shopping habits are fast changing to a gradual on-line ordering failed to prepare themselves. Non-food retail and logistic companies got the message and invested in this new channel of delivery. Supermarkets gave a nod in that direction and set up home delivery infrastructure for a minimum percentage of their overall retail. When COVID-19 hit, they were found wanting in their ability to scale up, thus missing a golden opportunity to steal a march on their competitors.

- Resilience: The facility to recover quickly from disastrous business, environmental, or social conditions will be a major factor in the survival and future prosperity of an organisation. I am amazed by how many large/very large companies who within days of the lockdown approached their respective governments with cups in hand begging for financial support almost as though it was their God-given right to be bailed out by the taxpayer. In fact, there is one example of a company who one week distributed dividends to shareholders and the following week approached the British government for multi-million pounds Sterling rescue package lest they go under. Whatever happened to reserving, cash is king and all that wise stuff? If the government does not respond to their financial support, and indeed they go bust, then the company leadership (executive and board of directors) are guilty in failing to carry out its duty to preserve the long-term interest of the company.

- Adaptability: Being able to adjust to new conditions must be another measure of strategy relevance. A restaurant already fully equipped to acquire quality ingredients, prepare and serve many covers on their premises should be able to make slight adjustments to their business model and offer take-out or home delivery service. This applies to a standard high street restaurant as well as top end gourmet eateries. They may not be able to generate the same levels of revenue as in the past but at least they can retain most, if not all their staff and keep the business ticking over.

- Scalability: So many supermarkets have benefitted from the COVID-19 Pandemic that you would think they got their strategies right. Well, they didn’t! Lady Luck smiled on them in spite of their shortcomings. To begin with, they allowed shelves to be left empty, thus promoting the false idea that there was a shortage of food supply. They then blamed the government for not allowing them to move goods during curfew hours of the night. When the government relaxed that particular rule, they were still unable to replenish stocks across the range. Secondly, as discussed in ‘Flexibility’ above, their business model was cast in concrete for most of their sales to be generated within their expensively set up stores with minimum capacity for home delivery. Should it come to pass that more and more of us will have a change in the way we work by remaining at home, food delivery is likely to grow and overtake actual store visits. Chances are forward thinking Machiavellian organisations such as Amazon and other similar distribution companies will steal a march on them through, for example, ‘Amazon Pantry’.

In the opening paragraph, I asked if you ever wondered why modern airplanes are less likely to experience disaster in mid-air than a car having a blow out or a train catching fire while in service. The reason is simple, and it is all to do with safety measures because such air disasters hardly ever leave any survivors. An airplane is designed with a certain degree of redundancy in its configuration. It can survive the loss of one of its engines, or damage to one of its wings and so on. This over-capacity comes at a significant cost however, it can make the difference between saving many lives or losing them, as well as loss or retention of the airline reputation and ultimately, survivability as a business.

Finally, I realise that having these extra measurement criteria is adding more pressure on a company to conduct business, however, it is up to the current and next generation of business leadership (executive and boards of directors) to learn from the mistakes and narrow vision of the previous crop of business leaders who, with the best of intentions, focused almost exclusively on maximising revenue/profit, to the exclusion of all other considerations.

Mufid Sukkar – April 2020